Are you tired of feeling overwhelmed by debt? Do you struggle to make ends meet, with creditors knocking on your door and high-interest rates sucking the life out of your finances? If so, you’re not alone. Millions of people around the world are trapped in a cycle of debt, with no clear escape route in sight. However, there is hope. The debt snowball method, popularized by financial expert Dave Ramsey, is a simple yet effective strategy for paying off debt and achieving financial freedom.

What is the Debt Snowball Method?

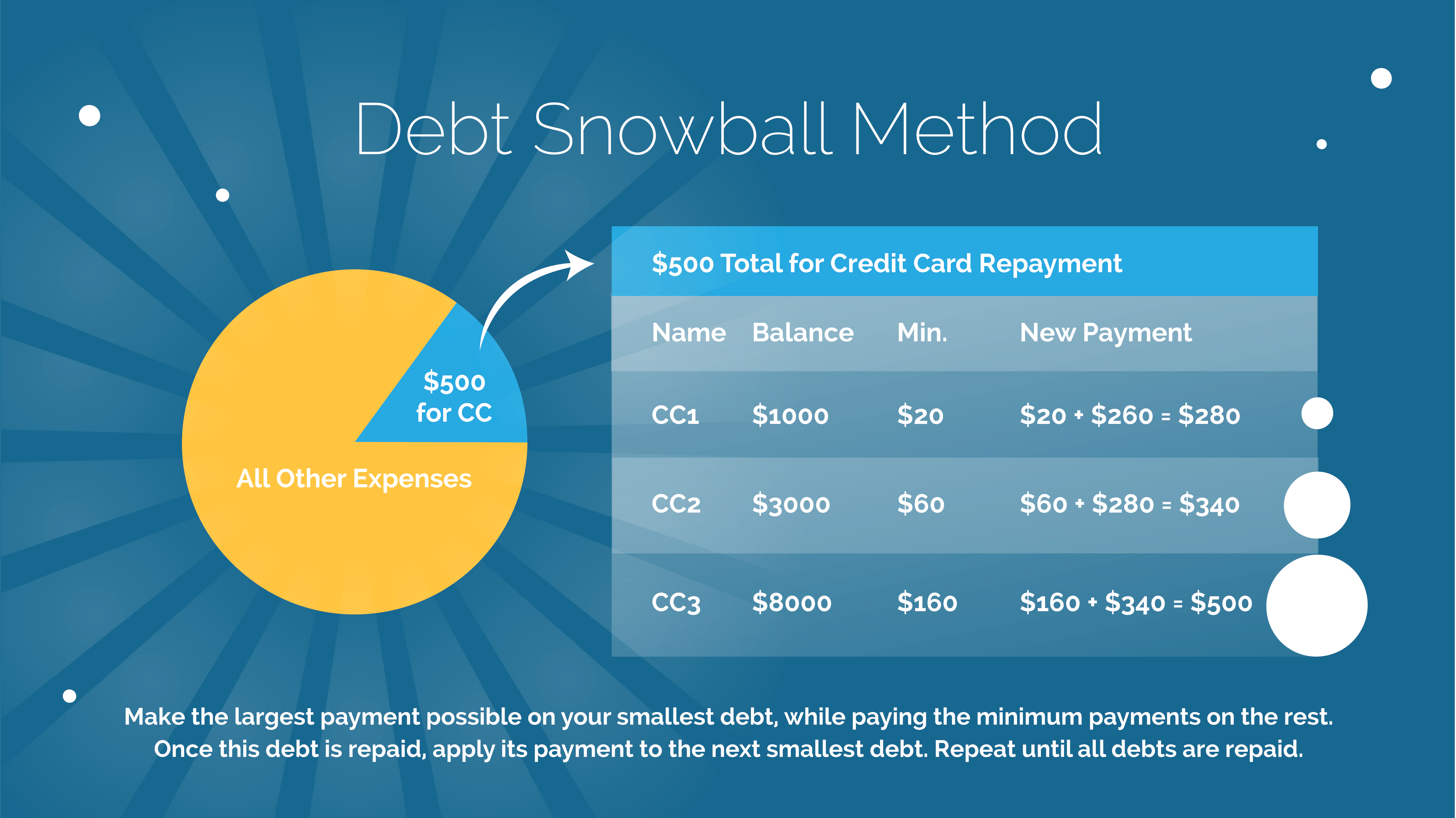

The debt snowball method is a debt reduction strategy that involves paying off debts in a specific order, with the goal of eliminating all debt as quickly as possible. The method is called a "snowball" because it starts with small, manageable payments that gradually build momentum, much like a snowball rolling down a hill.

Here’s how it works:

- List all debts: Start by making a list of all your debts, including credit cards, loans, and other obligations. Write down the balance, interest rate, and minimum payment for each debt.

- Sort debts by balance: Sort your debts in order from smallest to largest, based on the balance. This is the key to the debt snowball method: you’ll start by paying off the smallest debt first.

- Pay minimum payments: Make the minimum payment on all debts except the smallest one. For the smallest debt, pay as much as possible towards the balance.

- Pay off smallest debt: Continue making payments on the smallest debt until it’s paid off. This will give you a sense of accomplishment and momentum.

- Roll payments to next debt: Once the smallest debt is paid off, take the money you were paying on that debt and apply it to the next debt on the list. Continue this process, paying off each debt in turn, until all debts are eliminated.

How Does the Debt Snowball Method Work?

The debt snowball method works by leveraging the psychological power of quick wins. By paying off the smallest debt first, you’ll experience a sense of accomplishment and momentum, which will motivate you to continue the process. As you pay off each debt, you’ll free up more money in your budget to attack the next debt, creating a snowball effect.

For example, let’s say you have the following debts:

- Credit card with a balance of $500 and a minimum payment of $25

- Car loan with a balance of $10,000 and a minimum payment of $200

- Student loan with a balance of $30,000 and a minimum payment of $100

Using the debt snowball method, you would start by paying off the credit card balance of $500. You would make the minimum payment on the car loan and student loan, and as much as possible towards the credit card balance. Once the credit card is paid off, you would take the $25 minimum payment and apply it to the car loan, along with any extra money you can afford. This would help you pay off the car loan faster, and then you would move on to the student loan.

Benefits of the Debt Snowball Method

The debt snowball method has several benefits, including:

- Quick wins: Paying off small debts quickly gives you a sense of accomplishment and momentum.

- Simplified budgeting: By focusing on one debt at a time, you can simplify your budget and make it easier to track your progress.

- Motivation: The debt snowball method provides a clear plan and a sense of direction, which can help motivate you to stay on track.

- Reduced stress: As you pay off debts, you’ll reduce your stress levels and feel more in control of your finances.

Common Criticisms of the Debt Snowball Method

While the debt snowball method has been effective for many people, it’s not without its criticisms. Some argue that it’s not the most efficient method, since it doesn’t take into account the interest rates on each debt. Others argue that it’s too focused on quick wins, rather than making the most of your money.

For example, if you have a credit card with a balance of $500 and an interest rate of 20%, and a student loan with a balance of $30,000 and an interest rate of 6%, it might make more sense to pay off the credit card first, since it has a higher interest rate. However, the debt snowball method would have you pay off the credit card first because it has the smallest balance.

Alternatives to the Debt Snowball Method

If you’re not sure about the debt snowball method, or if you’re looking for alternative approaches, there are several other debt reduction strategies to consider. These include:

- Debt avalanche: This method involves paying off debts with the highest interest rates first, rather than the smallest balances.

- Debt consolidation: This involves combining multiple debts into a single loan with a lower interest rate and a single monthly payment.

- Debt management plan: This involves working with a credit counselor to create a plan for paying off debt, which may include consolidating debts, reducing interest rates, and negotiating with creditors.

Frequently Asked Questions

Here are some frequently asked questions about the debt snowball method:

- Q: How long does it take to pay off debt using the debt snowball method?

A: The length of time it takes to pay off debt using the debt snowball method will depend on the amount of debt you have, the interest rates on your debts, and the amount of money you can afford to pay each month. - Q: Is the debt snowball method the best way to pay off debt?

A: The debt snowball method is not the only way to pay off debt, and it may not be the best approach for everyone. However, it has been effective for many people and can be a good option for those who need a simple, straightforward plan. - Q: Can I use the debt snowball method if I have a lot of debt?

A: Yes, the debt snowball method can be used with large amounts of debt. However, it may take longer to pay off debt if you have a lot of debt, and you may need to consider alternative approaches, such as debt consolidation or a debt management plan. - Q: How do I know if the debt snowball method is right for me?

A: To determine if the debt snowball method is right for you, consider your financial situation, your debt, and your goals. If you have a lot of debt and are looking for a simple, straightforward plan, the debt snowball method may be a good option. However, if you have complex debt or are looking for a more customized approach, you may want to consider alternative methods.

Conclusion

The debt snowball method is a simple yet effective strategy for paying off debt and achieving financial freedom. By focusing on one debt at a time and making quick wins, you can build momentum and stay motivated to continue the process. While it’s not the only approach to debt reduction, it has been effective for many people and can be a good option for those who need a straightforward plan. Remember to consider your financial situation, your debt, and your goals when determining if the debt snowball method is right for you. With the right approach and a commitment to your goals, you can pay off debt and achieve financial freedom.

Closure

Thus, we hope this article has provided valuable insights into The Debt Snowball Method: A Proven Strategy for Paying Off Debt. We thank you for taking the time to read this article. See you in our next article!