Investing in the stock market can be a daunting task, especially for beginners. With numerous investment accounts available, it can be challenging to choose the right one that suits your financial goals and risk tolerance. In this article, we will explore the best investment accounts, their features, and benefits to help you make an informed decision.

Types of Investment Accounts

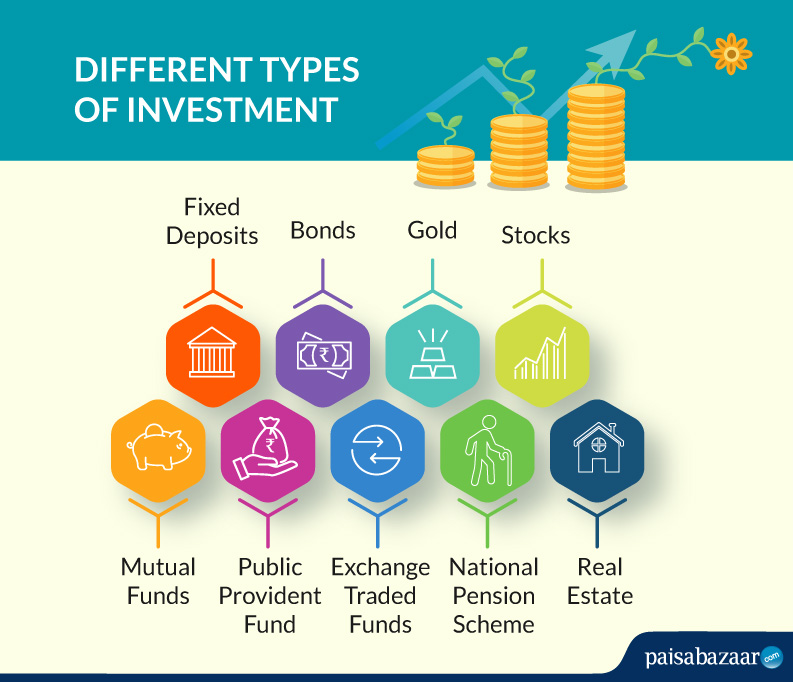

There are several types of investment accounts, each with its unique characteristics and advantages. Here are some of the most common types of investment accounts:

- Brokerage Accounts: A brokerage account is a basic investment account that allows you to buy and sell stocks, bonds, mutual funds, and other investment products. You can open a brokerage account with a brokerage firm, such as Fidelity, Charles Schwab, or Robinhood.

- Individual Retirement Accounts (IRAs): An IRA is a type of investment account that allows you to save for retirement while reducing your taxable income. There are two types of IRAs: traditional IRA and Roth IRA.

- 401(k) and Employer-Sponsored Plans: A 401(k) is a type of retirement plan sponsored by your employer. It allows you to contribute a portion of your salary to a retirement account on a pre-tax basis.

- Robo-Advisors: Robo-advisors are automated investment platforms that use algorithms to manage your investments. They offer low fees, diversification, and professional management.

- Index Funds and ETFs: Index funds and ETFs are investment products that track a specific stock market index, such as the S&P 500. They offer broad diversification and often have lower fees than actively managed funds.

Best Investment Accounts

Here are some of the best investment accounts in each category:

- Best Brokerage Account: Fidelity

Fidelity is one of the largest and most reputable brokerage firms in the world. It offers a wide range of investment products, including stocks, bonds, mutual funds, and ETFs. Fidelity’s trading platform is user-friendly, and its fees are competitive. - Best IRA: Vanguard

Vanguard is a well-known investment management company that offers a range of IRA accounts, including traditional and Roth IRAs. Vanguard’s IRA accounts have low fees, and its investment products are designed to help you achieve your long-term financial goals. - Best 401(k) and Employer-Sponsored Plan: Charles Schwab

Charles Schwab is a leading provider of 401(k) and employer-sponsored plans. Its plans offer a range of investment options, including stocks, bonds, and mutual funds. Charles Schwab also provides retirement planning tools and resources to help you achieve your goals. - Best Robo-Advisor: Betterment

Betterment is a popular robo-advisor that offers low fees, diversification, and professional management. It provides a range of investment portfolios, including socially responsible and income-focused portfolios. - Best Index Fund and ETF: Schwab U.S. Broad Market ETF

The Schwab U.S. Broad Market ETF is a low-cost index fund that tracks the Dow Jones U.S. Broad Stock Market Index. It offers broad diversification and has a low expense ratio of 0.03%.

Features and Benefits

Here are some key features and benefits of the best investment accounts:

- Low Fees: The best investment accounts have low fees, which can help you save money and achieve your financial goals.

- Diversification: Diversification is a key principle of investing. The best investment accounts offer a range of investment products, including stocks, bonds, and mutual funds, to help you diversify your portfolio.

- Professional Management: Some investment accounts, such as robo-advisors, offer professional management, which can help you achieve your financial goals.

- Retirement Planning: The best investment accounts, such as IRAs and 401(k)s, offer retirement planning tools and resources to help you achieve your long-term financial goals.

- Tax Efficiency: Some investment accounts, such as Roth IRAs, offer tax-free growth and withdrawals, which can help you save money on taxes.

FAQ

Here are some frequently asked questions about investment accounts:

- What is the minimum amount required to open an investment account?

The minimum amount required to open an investment account varies depending on the brokerage firm or investment product. Some accounts have no minimum balance requirement, while others may require a minimum of $1,000 or more. - What are the fees associated with investment accounts?

The fees associated with investment accounts vary depending on the type of account and investment product. Some accounts may have management fees, trading fees, or other expenses. - Can I withdraw money from my investment account at any time?

The ability to withdraw money from your investment account depends on the type of account and investment product. Some accounts, such as IRAs and 401(k)s, may have penalties or restrictions on withdrawals. - Do I need to be an experienced investor to open an investment account?

No, you don’t need to be an experienced investor to open an investment account. Many investment accounts, such as robo-advisors, offer professional management and diversified portfolios to help you achieve your financial goals. - How do I choose the best investment account for my needs?

To choose the best investment account for your needs, consider your financial goals, risk tolerance, and investment experience. You should also research and compare different investment accounts and products to find the one that best suits your needs.

Conclusion

Investing in the stock market can be a challenging but rewarding experience. With numerous investment accounts available, it’s essential to choose the right one that suits your financial goals and risk tolerance. In this article, we have explored the best investment accounts, their features, and benefits to help you make an informed decision. Remember to consider your financial goals, risk tolerance, and investment experience when choosing an investment account. With the right investment account, you can achieve your long-term financial goals and secure your financial future.

By following the guidance outlined in this article, you can make informed decisions about your investments and create a brighter financial future for yourself. Whether you’re a seasoned investor or just starting out, the best investment accounts can help you achieve your goals and reach your full financial potential.

Closure

Thus, we hope this article has provided valuable insights into The Best Investment Accounts: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!