As we approach our 40s, many of us start to think more seriously about retirement and how we can ensure a comfortable financial future. While it’s great to start saving for retirement early, it’s never too late to begin or to improve our existing retirement savings strategy. In this article, we’ll explore the importance of saving for retirement after 40 and provide tips and strategies to help you get on track.

Why Saving for Retirement After 40 is Crucial

Saving for retirement after 40 is crucial for several reasons:

- Time is of the essence: The sooner you start saving, the more time your money has to grow. Even if you’re starting late, it’s essential to begin saving as soon as possible to make the most of the time you have left before retirement.

- Compounding interest: When you start saving early, you can take advantage of compounding interest, which can significantly boost your retirement savings over time.

- Reducing financial stress: Saving for retirement can help reduce financial stress and anxiety, allowing you to focus on other aspects of your life, such as your career, family, and personal interests.

- Maintaining your standard of living: Retirement savings can help you maintain your standard of living in retirement, ensuring that you can enjoy the things you love and live comfortably without worrying about money.

Tips for Saving for Retirement After 40

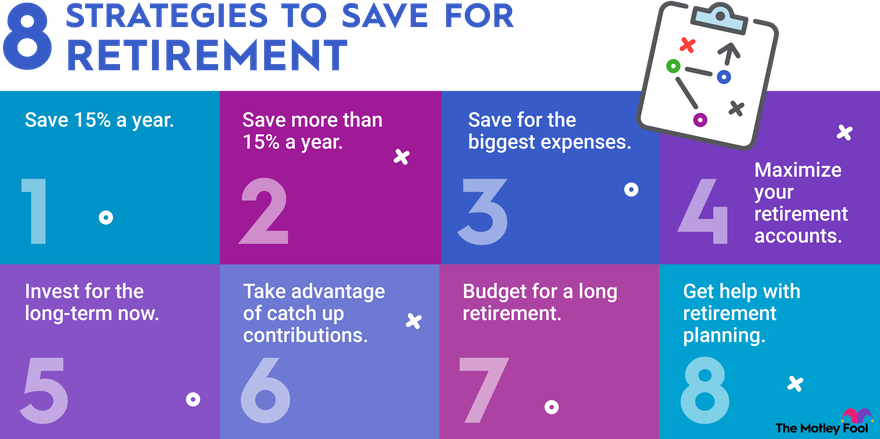

If you’re starting to save for retirement after 40, here are some tips to help you get on track:

- Start with a retirement goal: Begin by defining your retirement goals, including when you want to retire and how much you’ll need to live comfortably. This will help you determine how much you need to save each month.

- Take advantage of catch-up contributions: If you’re 50 or older, you can take advantage of catch-up contributions to your retirement accounts, such as 401(k) or IRA. These allow you to contribute an additional $6,500 to your accounts in 2022.

- Max out your retirement accounts: Contribute as much as possible to your retirement accounts, especially if your employer offers matching contributions.

- Consider a side hustle: Starting a side hustle or freelance work can help you earn extra income, which you can put towards your retirement savings.

- Automate your savings: Set up automatic transfers from your paycheck or bank account to your retirement accounts to make saving easier and less prone to being neglected.

- Invest wisely: Consider working with a financial advisor to create a diversified investment portfolio that aligns with your retirement goals and risk tolerance.

- Review and adjust your budget: Review your budget to see where you can cut back on unnecessary expenses and allocate that money towards your retirement savings.

Strategies for Saving for Retirement After 40

In addition to the tips above, here are some strategies to help you save for retirement after 40:

- The 50/30/20 rule: Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- The 4% rule: Aim to save at least 4% of your income towards retirement each year, and adjust this percentage as you get closer to retirement.

- Consider a Roth IRA: A Roth IRA allows you to contribute after-tax dollars, which can provide tax-free growth and withdrawals in retirement.

- Delay Social Security benefits: Delaying Social Security benefits can result in higher monthly payments, which can help supplement your retirement income.

- Downsize your expenses: Consider downsizing your expenses, such as selling a large home or reducing your transportation costs, to free up more money for retirement savings.

- Invest in a small business: If you have an entrepreneurial spirit, consider investing in a small business or side hustle to generate additional income for retirement.

- Seek professional advice: Consider working with a financial advisor to create a personalized retirement plan tailored to your needs and goals.

Common Retirement Savings Mistakes to Avoid

When saving for retirement after 40, it’s essential to avoid common mistakes that can derail your progress. Here are some mistakes to watch out for:

- Not starting early enough: Procrastination can be a significant obstacle to saving for retirement. Start as soon as possible, even if it’s just a small amount each month.

- Not taking advantage of matching contributions: Failing to contribute enough to your retirement accounts to maximize employer matching contributions can leave free money on the table.

- Not diversifying your portfolio: Failing to diversify your investment portfolio can put your retirement savings at risk. Consider working with a financial advisor to create a diversified portfolio.

- Withdrawing from retirement accounts too early: Withdrawing from retirement accounts too early can result in penalties and taxes, which can reduce your retirement savings.

- Not reviewing and adjusting your budget: Failing to review and adjust your budget regularly can lead to overspending and under-saving for retirement.

Frequently Asked Questions (FAQs)

- Q: How much should I save for retirement?

A: The amount you should save for retirement depends on your individual circumstances, including your age, income, and retirement goals. A general rule of thumb is to save at least 10% to 15% of your income towards retirement. - Q: What is the best way to save for retirement?

A: The best way to save for retirement is to start early, be consistent, and take advantage of tax-advantaged retirement accounts, such as 401(k) or IRA. - Q: Can I still save for retirement if I’m starting late?

A: Yes, it’s never too late to start saving for retirement. Even small, consistent contributions can add up over time. - Q: How do I know if I’m on track with my retirement savings?

A: Review your retirement savings regularly and adjust your strategy as needed. Consider working with a financial advisor to create a personalized retirement plan. - Q: What are the benefits of saving for retirement?

A: Saving for retirement can provide peace of mind, financial security, and the freedom to pursue your passions and interests in retirement.

Conclusion

Saving for retirement after 40 requires discipline, patience, and a well-thought-out strategy. By starting early, taking advantage of catch-up contributions, and investing wisely, you can create a comfortable financial future for yourself. Remember to avoid common mistakes, such as not starting early enough and not diversifying your portfolio, and seek professional advice if needed. With the right strategy and mindset, you can achieve your retirement goals and enjoy the freedom and security that comes with it. So, take the first step today and start building the retirement you deserve.

Closure

Thus, we hope this article has provided valuable insights into Saving for Retirement After 40: Tips and Strategies. We appreciate your attention to our article. See you in our next article!